Renewable systems can have great engineering performance but, unless you check carefully, it’s easy to choose a system:

- whose costs outweigh its benefits, or is;

- not optimally sized for your home.

As a result, each system should be appraised and compared financially.

There are several ways to do this, such as choosing the one with the shortest payback period, or the one with the highest internal rate of return (IRR) or highest net present value (NPV).

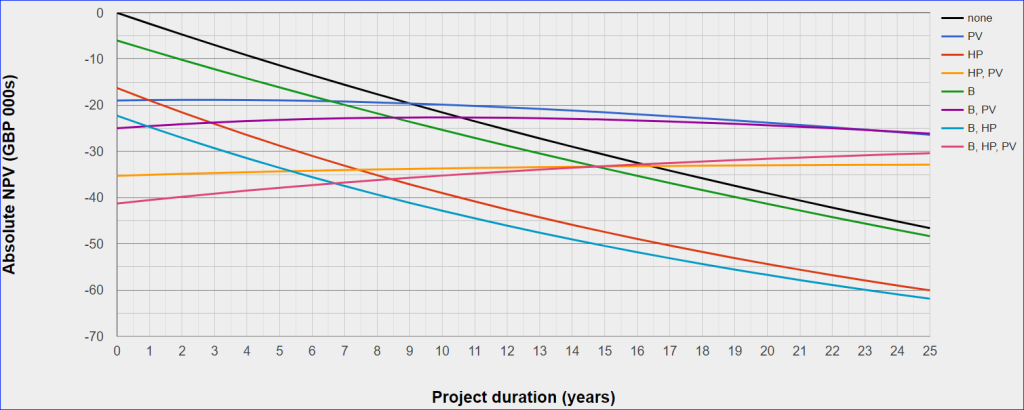

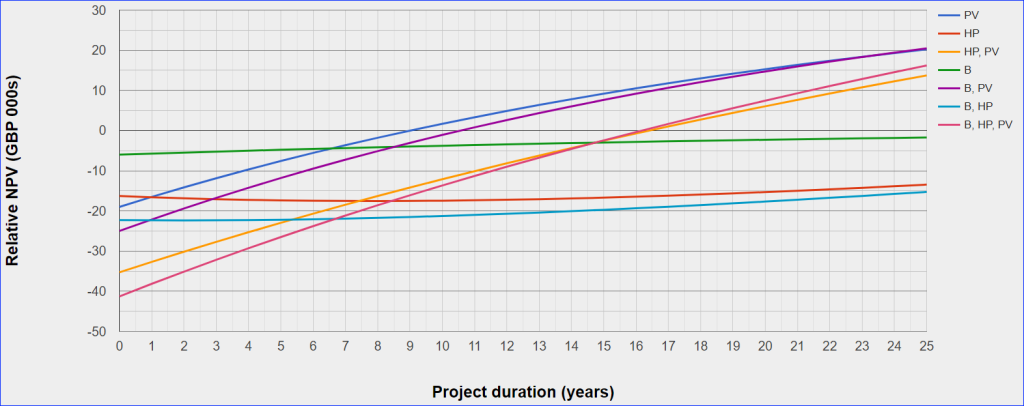

When comparing renewable systems, NPV is best because payback and IRR do not consider size of investment. For example, adding a tiny PV system with just a few panels to Windsor Castle castle might pay for itself quickly and show a great IRR … but it would make little difference. Payback and IRR won’t tell you how much better you off you would be compared to doing nothing.

Payback and IRR also ignore opportunites foregone. For example, does a £50,000 ground source heat pump that saves £2,500 a year in electricity costs make sense if we have to fund it by selling stocks that average a 10 percent return? Payback has nothing to say on this, but IRR does. If the project’s IRR, in this example case 5 percent = £2,500 divided by £50,000 (assuming the heat pump lasts forever), is less than the 10 percent expected elsewhere … we shouldn’t go for it.

NPV estimates each system’s absolute financial value and compares this to doing nothing or investing elsewhere.

The NPV formula:

\text{NPV} = \sum_{t=0}^{n} \frac{I_t}{(1 + r)^t}

estimates how much a project is worth today if you go ahead with it.

It divides all incomes and costs (negative), associated with the project by a discount factor and adds them all together.

Consider for example a heat pump + solar PV system. This has a bunch of initial (t=0) planning, purchase and install costs. Then it has a series of costs such as electricity and maintenance charges throughout the project’s life and, hopefully, also positive incomes from solar exports.

Each income amount is divided by a factor (1+r)t to reflect that monies at an expected time, t, in the future is less interesting than money in the bank today. r is the discount rate and varies widely according to market factors (i.e. interest and inflation) and your own personal attitude to risk and investment.

NPV is only as good as the assumptions made when using it so that, while its formula is conceptually simple, the process of calculating each term, even with a spreadsheet, can be tedious and slow due to the complexity of most renewable components.

While the NPV formula is simple large formulae, typicallly using many parameters, are required to acurately describe each renewable component.

Calculation complexity increases further when components are combined. For example, a heat pump with multiple solar PV arrays and a storage battery.

Another complication is electricity cost. Gone are the days when electricity had a single price. These days tariffs, especially the ones for homes with renewables, fluctuate throughout the day in ways that defy estimating intuitive averages.

For these reasons and more besides, rigorous NPV calculation appears seldom used when appraising domestic renewable designs. It has simply been too difficult.

For me that is a pity, because the investment required from me was large, running into several £10ks, and I wanted to be confident that I was getting the best system our money could buy.

While you may not want to be ruled by financial measures when saving the planet, the counter argument is that NPV allows you, where desired, to favour investments that maximise CO2 saving per investment. To achieve this just price its cost saving and add it to the NPV formula.